The equity-linked savings scheme (ELSS) is a product where you can make online investments up till 3PM on the day when stock market is open.

If you still have not zeroed in on a financial product to invest in to reduce your tax outgo for the year, you can take the online route.

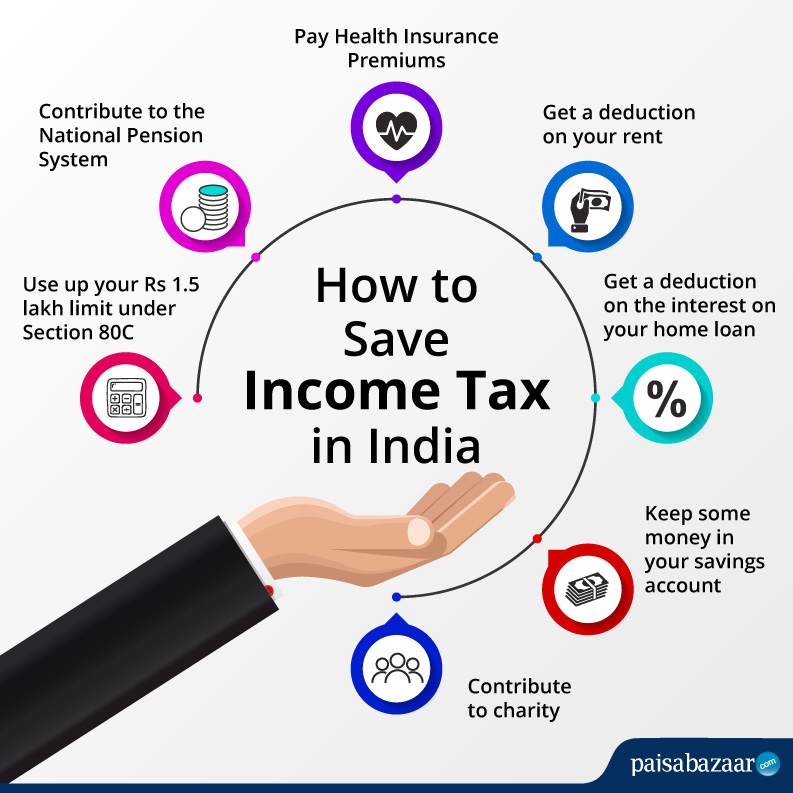

Here are few tax-saving options which can be made online where you do not have to issue a cheque. However, do keep in mind that there could be glitches while making these online transactions at the last minute. It’s always better to get in touch with the company and then proceed after getting a confirmation from them regarding the availability of tax benefit on the transaction made today.

1. Five-year bank fixed deposit

The five-year tax-saving fixed deposit is the probably the most hassle-free way of making an online tax saving investment. If you have a know-your-customer (KYC) compliant account, all you need to do is log into your Net banking account and invest from there. Make sure your PAN is updated in the bank’s records. Redemption on maturity comes directly to your bank account.

You can indicate whether you want monthly, quarterly or cumulative interest on the investment. The interest earned is to be added to one’s income and is entirely taxable. Currently, the interest rate on 5-year bank fixed deposit is 6.5- 7 per cent (additional 0.5 percent for seniors). The post-tax return for someone in the highest income slab comes to about 4.4 to 4.8 percent per annum. Do keep in mind that although a product like this helps in saving taxes and will preserve your capital, it will not help in wealth creation over a long run.

2. Insurance

Buying insurance plans such as online term plan or unit-linked insurance plans (Ulips) at the last minute may not always work. Although making payments online is possible through cards or Net banking, the underwriting of the policy might call for medical tests which could result in a decline of the policy or the insurer might ask for ‘extra premium’ owing to adverse medical reports.

For instance, let us say you buy insurance online on the last working day of the FY and the policy actually gets issued during the first week of April (i.e., in the next financial year). Although you will be eligible for the tax benefit, if the policy doesn’t get issued, you will not get the tax benefit. However, the premium amount is refunded.

3. Ulips

One can buy online Ulips by visiting the insurer’s website. As there is no intermediary involved, there is no commission that gets paid to any agent in online Ulips. The process of applying and making payment through net banking or credit card will be entirely online. With some insurers, Aadhaar number may be mandatory to buy policy online.

4. PPF

Opening of a Public Provident Fund (PPF) account with a designated bank in itself will take few days. You can only fill up the form online by logging into your Internet banking account. You will have then take a printout of the form and submit it along with certain other documents at the bank branch for verification.

But, if you already have a PPF account, you can transfer the funds online from linked savings account of same or another bank. You can also set a standing instruction for online fund transfer to the PPF account.

5. Home loan repayment

If you have a home loan, any principal repaid through equated monthly instalments (EMI) or through lump sum prepayment qualifies for the section 80C benefit. At this last juncture, you can prepay a portion of your home loan and not only save tax but also save on interest cost. Prepayment helps in reducing the total interest outgo as the loan tenure gets reduced. The higher the prepayment amount and the longer the period, the more will be your savings.

For doing it online, you have to add your home loan account as a third-party account through your bank’s net banking and then transfer the funds as required. It’s faster doing it online than going to bank branch with a cheque to repay a portion of your loan.

6. Health cover

One may buy health insurance online by visiting the website of any general insurance company or a standalone health insurance company. However, there could be a requirement of medical tests or the insurer may not allow buying online above a certain age or a sum insured. Generally, insurers allow individuals up to the age of 45 to buy health insurance plans online.

7. ELSS

One can only make online investments in equity-linked savings scheme (ELSS) up till 3PM on days when stock market is open.”If you invest online any time after 3 PM, investments would be accepted at the NAV of the units on the next day that stock markets are open,” according to Ashwin Karmarkar, Director, KW Wealth Advisors, a financial consultancy firm. You can invest in ELSSs online by visiting the fund house’s website. However, you need to be KYC compliant.

Through Net banking, if the investment is made before 3 pm, the same day’s net asset value (NAV) gets allocated. Therefore, if you invest before 3 pm today your investment would be reflected in the account statement as having been made on that date.

By investing online, you can choose between the regular and direct options. As against a regular option, the direct option has lower expenses as it is free of distribution commission. In the long run, it will translate into huge savings. Cho ..

Watch outs

It’s always better to call up the company before initiating the process of investing online. It would typically take 1 working day for the investment to go through. Also, there are certain specific nuances with the process involved and knowing them beforehand will make the online experience better. For example, not all cities could be enrolled by the insurer for buying online term plans.

Before picking from these products, do keep in mind that you should not invest in something merely to save tax at the last minute. Make sure they are in sync with your financial plans-you do not want to end up with a dud investment, right?

More Stories

Discover Tax-Free Gift Options

Stay Informed: Tax Return Changes Ahead

Tax update: 11 rules you need to know